Financial protection for you and your family

The 5Star Life Insurance Company (5Star Life) Accident coverage provides cash benefits from day one for medical treatment you receive for covered accidents and injuries, regardless of what your medical insurance pays. You can also use the cash to pay for other unexpected expenses that come up after an accident, like childcare or transportation, providing you coverage that helps offset the cost of medical treatment and non-medical expenses.

This insurance covers treatment and hospitalization resulting from an accident covered by the policy your employer selects. In addition, benefits can provide coverage for broken bones, dislocations, ligament damage, transportation for treatment, health screening tests, and a host of other items.

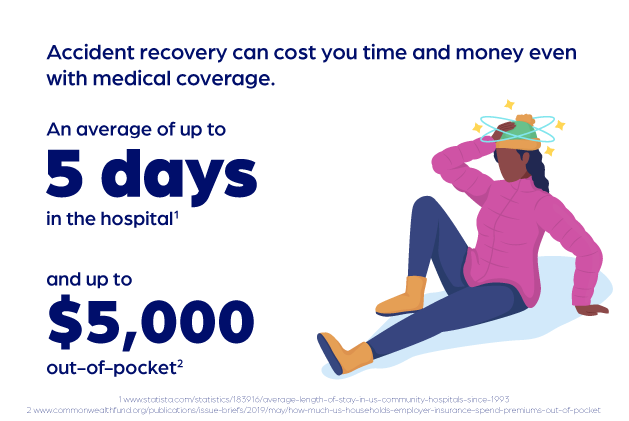

Accidents happen

An illness or injury could keep you from earning a paycheck and potentially cause you financial pain. Think about everyday expenses such as child care, utility bills, and mortgage and car payments. 5Star Life Accident Insurance could help make your recovery a little less painful.

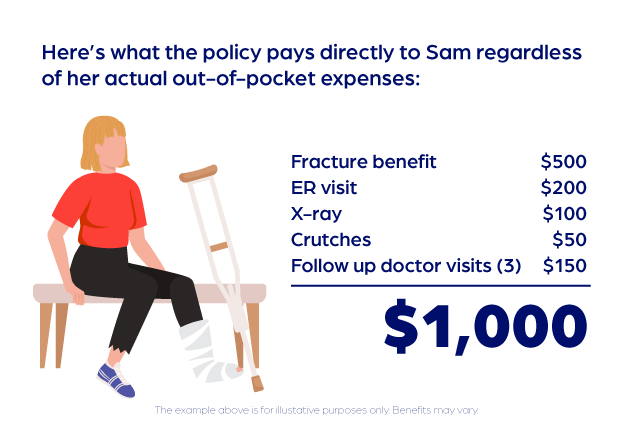

How coverage works

Sam breaks her leg. While her major medical coverage takes care of some of the medical costs, she also has 5Star Life Accident coverage. She can use the cash benefits for copays and deductibles, for transportation now that she can’t ride her bike to work, and hire a babysitter to watch her child while she goes to follow-up doctor visits.

Coverage features

Financial back-up

Guards against the potential financial gaps created by deductibles and co-pays.

Direct payment

Benefits are paid directly to you to help cover any unexpected expenses during recovery.

Easy to use

Payments are not reduced by or coordinated with any other policies, including major medical coverage.

Preventative care benefit

Benefit is an important part of a health maintenance program and is the best bet for early detection of significant health risks.

Preventative care benefit

This benefit pays once per year, per covered person and is paid directly to you regardless of actual out-of-pocket expenses. Covered tests include, but is not limited to:

- Routine physical exam

- Hemoglobin (A1c)

- Dental Exam

- Optometrist Exam

- Weight reduction program

- Stress test

- Bone Density Screen

- Sleep Test (Epworth Sleepiness Scale)

- Concussion Testing (Baseline)

We're here to help

Visit the Support Center to file a claim, make a payment or change to your account, answer questions about your coverage, and more.

Product underwritten by 5Star Life Insurance Company (a Lincoln, Nebraska company). Product not available in all states. Policy #: 5SACPOL; Rider 5SACSCFR